- Morgan Stanley plans to reduce its workforce by about 2% to 3%, aligning with its strategic focus on efficiency and automation.

- This restructuring, under CEO Ted Pick, entails cutting around 2,000 jobs, with financial advisers remaining unaffected to support the firm’s client-centric strategy.

- The decision highlights a proactive cost management approach, preparing Morgan Stanley for an AI-driven future.

- New senior talents are being recruited for investment banking, signalling confidence in a future economic recovery.

- This transformation reflects a broader Wall Street trend, as peers like Goldman Sachs and Bank of America also streamline their workforce.

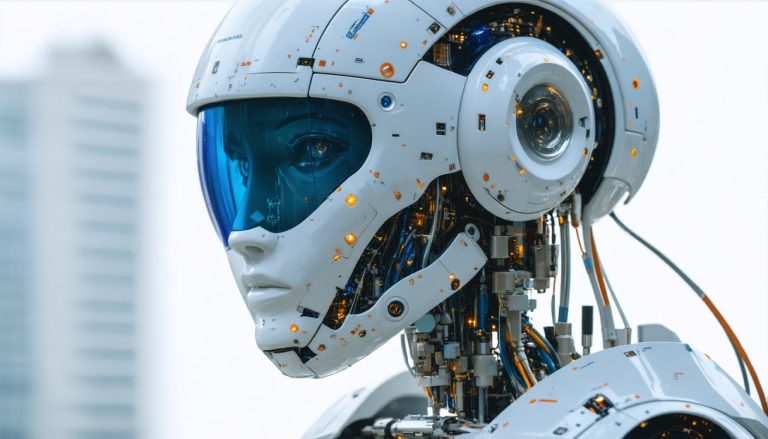

- Emphasis on technology underscores a dynamic shift, prompting reflection on the evolving role of human effort in a machine-led world.

Through the bustling streets of New York City’s financial district, winds of change sweep across the glass towers of Morgan Stanley. The prestigious investment bank teeters on the edge of transformation, preparing to sever ties with 2,000 employees in a bold restructuring manoeuvre led by CEO Ted Pick. Such a decisive move represents the first significant workforce reduction under Pick’s leadership, redefining the company’s operational landscape amid the rise of artificial intelligence and automation.

This workforce culling marks a critical point as Morgan Stanley, a titan with over 80,000 employees worldwide in 2024, seeks to trim approximately 2% to 3% of its workforce. The reduction is a strategic pivot aimed at enhancing operational efficiency by selectively letting go of employees based on performance, location alterations, and the inexorable rise of automation technologies. Interestingly, this reshuffle spares the cadre of around 15,000 financial advisers pivotal to the firm’s client-centric ethos.

While the streets hum with murmurs of economic uncertainty, Morgan Stanley remains undeterred, orchestrating its cost management symphony not due to market stimuli but rather as a proactive recalibration in a world where machines play an increasingly significant role. The future, as envisioned by Pick and his crew, transcends routine cost-cutting, hinting at a futuristic tableau where efficiency merges seamlessly with strategic foresight.

At a recent financial summit, the bank’s co-president, Dan Simkowitz, painted a landscape where mergers, acquisitions, and new equity issues linger in the shadows, paused yet hinting at resurgence. These foundational activities rest momentarily, waiting for the pendulum of capital markets to swing toward recovery. Meanwhile, as an anticipatory measure, Morgan Stanley fortifies its upper echelon, welcoming fresh talent into its senior investment banking ranks, demonstrating faith in an imminent economic revival.

This shift at Morgan Stanley mirrors a broader pattern among Wall Street stalwarts, each grappling with the unpredictable tides of the economic sphere. Goldman Sachs, for instance, intensifies its evaluative processes, plotting to trim up to 5% of its workforce. Meanwhile, Bank of America discreetly prunes its personnel, parting with 150 junior bankers in a bid to realign its investment banking division.

The narrative unfolding at Morgan Stanley is more than just a tale of job cuts; it is a testament to the relentless evolution of the financial sector. Here, amidst the symphony of keyboards and data streams, machines echo the future, urging us to ponder the place of human endeavour in a world increasingly driven by algorithms. The essence of this transformation lies in its embrace of technology, promising efficiency while inspiring a provocative dialogue on the partnership between human intelligence and artificial dexterity. Keep an eye on Morgan Stanley, for this is not merely a chapter; it is the beginning of uncharted financial frontiers.

Morgan Stanley’s Workforce Restructuring: Navigating New Financial Frontiers

Overview of Workforce Changes at Morgan Stanley

Morgan Stanley’s recent decision to reduce its workforce by approximately 2,000 employees marks a significant transformation in the financial sector. Under the leadership of CEO Ted Pick, this restructuring represents a strategic shift towards enhancing operational efficiency through the adoption of automation and artificial intelligence. While the move is not driven by immediate market pressures, it signals a proactive approach to aligning with the evolving technological landscape.

Key Facts and Insights

1. Automation and AI in Banking: The rise of automation and artificial intelligence is a critical factor in Morgan Stanley’s restructuring efforts. AI technology is increasingly being used across financial operations to optimise processes, enhance decision-making, and reduce costs. This shift toward technology is expected to reshape roles within the banking industry, emphasising the need for employees skilled in digital technologies.

2. Preservation of Financial Advisors: Despite the job cuts, the bank has strategically chosen to retain its core team of approximately 15,000 financial advisers. These advisers remain crucial to Morgan Stanley’s client-centric operations, highlighting the firm’s commitment to maintaining strong client relationships despite internal changes.

3. Executive Reshuffling and Future Prospects: In anticipation of an economic upturn, Morgan Stanley has bolstered its senior investment banking ranks by recruiting new talents. This move reflects the bank’s strategic foresight in preparing for a resurgence in mergers, acquisitions, and equity markets when the capital markets recover.

4. Comparison with Industry Peers: Morgan Stanley’s actions echo a broader trend among major Wall Street firms as they adjust to economic uncertainties. For example, Goldman Sachs plans to reduce its workforce by up to 5%, while Bank of America has recently let go of 150 junior bankers, demonstrating a similar focus on operational alignment and efficiency.

How-To Steps for Navigating Workforce Changes

– Upskilling Initiatives: Employees in the financial sector should consider investing in upskilling by gaining expertise in AI, machine learning, and other emerging technologies to maintain relevance and adaptability in an evolving landscape.

– Decoding Organisational Shifts: For those affected by workforce changes, understanding the strategic direction of a firm is crucial. This involves staying informed about industry trends and how they influence organisational decisions.

Market Forecasts and Industry Trends

The financial sector is poised for considerable growth driven by technological advancements. According to McKinsey & Company, AI technologies could generate up to $1 trillion in additional potential within the global banking industry by 2030. As institutions like Morgan Stanley enhance their technological capabilities, the industry’s focus will likely shift towards innovation-oriented business strategies.

Recommendations for the Financially Active

– Consider Emerging Opportunities: Whether you are an employee or an investor, explore roles or investments in technology-driven projects and initiatives within the financial services sector to harness the benefits of automation and digital innovation.

– Network and Stay Informed: Keeping abreast of industry changes, building networks, and learning from peers and experts can offer insights into emerging trends and opportunities.

– Monitor the Economic Climate: Stay vigilant about economic indicators and market sentiments that could influence financial recovery and investment decisions.

For more insights, visit the [Morgan Stanley](https://www.morganstanley.com) website. Each chapter of change in the financial sector holds potential for opportunity, and as markets continue to evolve, those prepared to adapt will thrive.