- President Trump’s new tariffs, termed “Liberation Day,” disrupt global commerce, echoing the disruptive effects of Covid lockdowns.

- Unusual tariff targets include the British Indian Ocean Territories and Heard and McDonald Islands, raising questions about strategic intent.

- Tech sector, led by AI, emerges as a resilient force, using advanced technologies to adapt and streamline supply chains.

- Removal of tariff exemptions for goods below $800 challenges online retailers like Shein and Temu, requiring strategic recalibration.

- Bitcoin and cryptocurrencies gain appeal as investors seek alternatives amid uncertainty in fiat currency confidence.

- Trump’s tariffs are seen as negotiation tactics, pressuring nations into potentially altering alliances and trade terms.

- The evolving landscape underscores the importance of adaptability, with tech and crypto offering paths to navigate global economic shifts.

As tensions ripple through international markets, a new economic storm brews under the banner of the latest tariffs proclaimed by President Trump. Dubbed as “Liberation Day,” the move is anything but liberating for the global commerce landscape. Instead, it has delivered a tremor akin to the disruptive impact of the Covid lockdowns, leaving economies scrambling and experts pondering the true stratagem behind this geopolitical gambit.

Shrouded in controversy, the tariffs have oddly targeted far-flung territories such as the British Indian Ocean Territories and the remote Heard and McDonald Islands—an action baffling in both strategic intent and practical consequence. Some speculate the influence of an AI-driven agenda, while others suggest this is another complex maneuver in Trump’s long game of power politics.

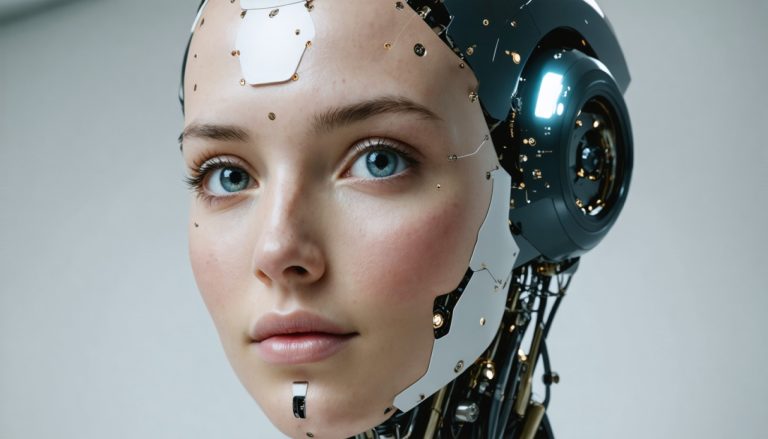

Amidst this upheaval, the tech sector has emerged as a beacon of potential resilience. Industry leaders are now harnessing the prowess of artificial intelligence and intelligent payment systems to navigate the choppy waters of cross-border trade. David Villalón, steering the helm at Spanish AI frontrunner Maisa, sees an opportunity amidst the chaos. He champions AI as an indispensable ally, poised to streamline the tumult of rapid changes and safeguard global supply chains with unprecedented precision.

Yet, retail faces a disquieting shift. The removal of tariff exemptions for goods below $800 spells looming challenges for online empires, sending tremors through enterprises like Shein and Temu that thrive on the cross-border consumer culture. Payment solutions, once merely transactional tools, now transform into strategic arsenals as retailers recalibrate their operations to absorb the shockwaves of increased duties and elongated customs processes.

Interestingly, while traditional markets reel, the crypto realm stands to gain. With confidence in fiat currencies visibly shaken, Bitcoin and its brethren emerge as potential sanctuaries for wary investors. Ryan Lee of Bitget Research underscores Bitcoin’s allure as a decentralized refuge amid the turmoil of tariff-induced uncertainties, predicting a surge in interest as confidence in conventional financial systems wanes.

The chessboard remains intense, with Trump’s tariffs casting longer shadows on America’s trading partners. Although these measures appear to flex U.S. economic might, the reverberations extend well beyond American shores. Strategists like Mark Pearson of Fuel Ventures dissect the motives as a potent negotiation tactic, coercing nations into dialogues that might otherwise never transpire.

Yet, the path forward for affected nations is fraught with complex decisions—capitulate to new terms or engage in a high-stakes counter-play. The European Common Market’s considerable population offers some insulation, while smaller economies face a strategic dilemma—succumb to U.S. terms or stake out new alliances.

The unfolding drama of tariffs reaffirms a central truth in the world of commerce: adaptability is the ultimate currency. The tech and crypto sectors remind us that while economic landscapes shift, innovation and foresight hold the keys to seizing new opportunities amid the chaos. The challenges might be daunting, but from the turbulence, a new order of global trade is emerging—one where resilience is redefined, and strategies are recalibrated for a future that favors those who can navigate the unpredictable dance of global economies.

Trump’s Tariffs: Unveiling New Opportunities Amid Economic Uncertainty

Understanding Trump’s Tariffs

The latest wave of tariffs announced by President Trump has sent ripples across international markets, reminiscent of the disruptions caused during the Covid lockdowns. Dubbed “Liberation Day,” these tariffs are designed to project U.S. economic might but have left many experts puzzled over their strategic intent, especially given their unusual targets such as the British Indian Ocean Territories and the Heard and McDonald Islands.

Industry Responses and Innovations

Tech Sector’s Resilience: The tech industry is leveraging artificial intelligence (AI) to weather the storm. As cross-border trading becomes increasingly complex, the role of AI in managing supply chains has never been more crucial. Companies like Maisa are demonstrating how AI can optimize logistics, foresee fluctuations, and ensure continuity despite external shocks.

Transforming Retail Payment Systems: Retailers face significant challenges with the removal of tariff exemptions for products under $800. Companies like Shein and Temu must innovate, utilizing advanced payment solutions that offer strategic flexibility to absorb tariff-related costs and maintain consumer satisfaction.

Cryptocurrency’s Rising Role: The cryptocurrency market is poised for growth as traditional fiat currencies see decreasing confidence due to uncertain global trade conditions. Bitcoin is gaining traction as a stable store of value, promising investors a decentralized alternative to safeguard their wealth from tariff-induced volatility.

Market Impacts and Strategies

Strengthening Negotiations and Alliances: Trump’s tariffs are seen by some, such as Mark Pearson of Fuel Ventures, as negotiation tools to coerce international dialogue that might not occur otherwise. Nations must now choose whether to negotiate under U.S. terms or form new alliances to counterbalance the economic pressures.

Implications for Smaller Economies: Smaller economies must navigate a precarious balancing act. While the European Common Market provides some refuge with its population strength, smaller nations may be forced to either conform to U.S. tariffs or diversify their alliances to sustain themselves.

Industry Trends and Predictions

1. AI Integration: AI is increasingly becoming integral across industries, particularly in the logistics and supply sector. Adoption of AI could streamline complex international trade operations, reducing the impact of tariffs.

2. Crypto Stability: Cryptocurrencies like Bitcoin are expected to see increased adoption as perceived havens against traditional financial volatility, offering investors an attractive alternative.

3. Retail Innovations: Retailers must plan for new operational models that integrate intelligent payment solutions to adjust smoothly to changing tariff landscapes.

4. Strategic Alliances: As tensions rise, countries are likely to seek new trading partners, potentially foreseeing a shift in global trade networks driven by geopolitical strategies.

Actionable Recommendations

– Leverage AI: Businesses should explore AI-driven solutions to optimize and future-proof supply chain operations.

– Embrace Crypto: Investors should consider diversifying portfolios with cryptocurrencies to hedge against currency instability.

– Enhance Payment Systems: Retailers should invest in technology that enables dynamic pricing and tariff adjustment to stay competitive.

– Monitor Trade Dynamics: Companies globally must stay informed on trade negotiations and realign business strategies to anticipate market shifts.

Explore more about economic insights and trends at Bloomberg.

Resilience in the face of economic challenges is paramount, and with innovation, nations and businesses can emerge stronger, turning potential setbacks into strategic opportunities.